Open Source in Quantitative Finance

– The Revolution.

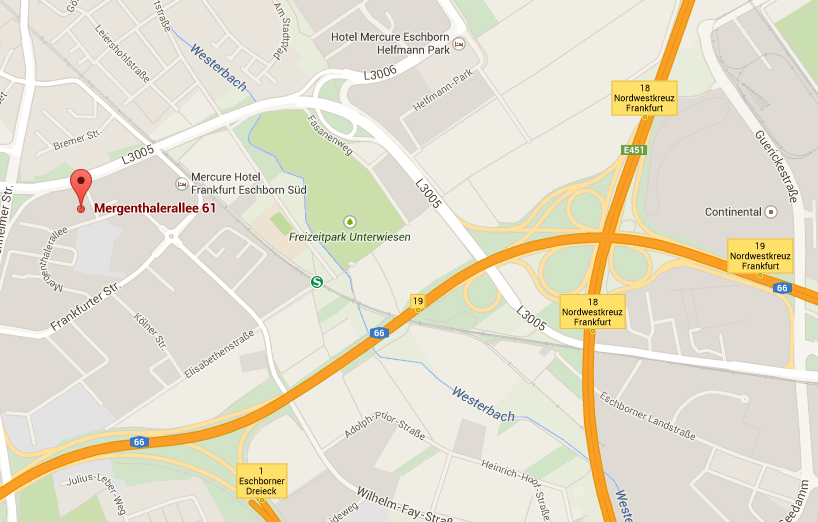

Frankfurt/Eschborn, 05. June 2015, 9-17h

The Cube, Deutsche Boerse Group

Buy your ticket. Learn more

Learn about the benefits of Open Source languages like Python, Julia, R or Scala.

Get an overview of what tools the Open Source world provides for Quant Finance.

Learn about Open Source backend and big data technologies useful for Quant Finance.

At Quantopian we love open source. Quantopian provides a browser-based IDE to develop trading algorithms in Python. These algorithms can be backtested and deployed live with a brokerage account. More recently, Quantopian launched an IPython Notebook based research platform. All these technologies rely heavily on open source software. But we also give back to the community, our full backtester software called Zipline has been open source since inception and received dozens of user contributions. When we have a good change to an open source project, we provide a patch.

In this talk I will discuss common concerns about open sourcing one's own code, highlight the benefits — of which there are many — as well as share our own experiences in running an successful open-source project.

It is complex, costly and risky to deploy heterogeneous open source components across an organization. Web-based technologies allow for a central, unified deployment with end users only needing a (current) browser. Such a strategy facilitates introduction and maintenance of Open Source components for Quant Finance.

Yves illustrates such a systematic deployment strategy by some use cases based on the Quant Platform (cf. http://quant-platform.com) and datapark.io (cf. http://datapark.io).

Saeed illustrates in his talk the use of (unstructured & structured) Big Data in financial trading by the means of two case studies.

The first case study is about trading bond futures & FX using RavenPack news data. The seconds illustrates the use of FX tick data to understand stylized properties of intraday FX behaviour — it also includes Python code examples.

A combination of C/C++, Java, R and Python is currently the preferred option when tackling real world projects in the financial sector.

In this talk, Malcolm discusses the strides being made in the Julia community and poses the question: "Is Julia ready for the enterprise?", indicating how, when coupled with asynchronous operations, significant improvements in performance can be achieved by the use of this dynamically compiled language (using LLVM).

In this talk we will see the power of Python in building an energy trading business from scratch. From data capture and visualisation, to portfolio valuation and optimisation, to strategy testing and automated reporting, all the way to the deployment as a Web application or in Excel — the Python ecosystem provides a suite of powerful tools to get the job done cleanly and quickly.

In situations where there is a high premium on performance, close-to-the-metal languages (like C/C++) can be easily integrated.

Although there are often new and more sophisticated tools emerging in the world of quantitative finance, Excel is usually still somewhere involved. xlwings is an Open Source Python package that connects Excel with Python on both Windows and Mac. It allows you to interact with Excel from IPython Notebooks or any other Python environment and also enables you to replace VBA macros with Python code.

This talk will give an overview of the current Excel/Python landscape and will demo xlwings' ease of use. The demo will also include examples from finance where Excel merely acts as a user front end.

We show how a combination of Python, C++ and D3.js allows us to visualize and analyze the order books for futures at Eurex.

The orderbook viewer tool allows to drill down to single orders as well as to give a visual impression of the order book dynamics and market micro structure.

Risk Management is driven by distinct but interdependent processes (e.g. VaR calculation, stress testing). Although posing different non-functional requirements — such as performance, frequency and data volume — these processes must be functionally consistent. Such diverse requirements are usually contradictory, inevitably leading to complexity.

We evaluate, with concrete coded examples, existing open source tools from the Risk Analytics and complexity handling point of view. The examples use mainly the PyData (e.g. Pandas, Bokeh) stack and the Apache Spark framework.

Chris will demonstrate — mainly using IPython Notebooks — the plotting of interactive 2d and 3d financial graphs using both Python and R. In addition, the Cufflinks library will be shown which binds together Plotly and the data analytics library Pandas for carrying out the complete data analysis workflow in Python.

In this talk, Jorge will demonstrate what the future holds for Quants using and retrieving financial data from Thomson Reuters via an upcoming, unified Python-API.

| 9:00 | Dr. Dragos Crintera Deutsche Boerse Group |

Keynote "Building Tomorrow Slides |

|

| 9:30 | Dr. Yves Hilpisch The Python Quants |

Open Source in Quant Finance Slides |

|

| 9:45 | Thomas Wiecki, PhD Quantopian |

Open Source Software at Quantopian Abstract | Slides |

|

| 10:15 | Saeed Amen Thalesians |

Using Big Data for Trading Bond Futures & FX Abstract | Slides |

|

| 10:45 | MORNING BREAK | ||

| 11:15 | Dr. Teodora Baeva BTGPactual |

Python for Quant Finance — Success Stories from the Trading Floor Abstract | Slides | Github Repo |

|

| 11:45 | Jorge Santos Thomson Reuters |

New Python-API of Thomson Reuters Abstract |

|

| 12:15 | Sebastian Neusüß & Pavel Schön Deutsche Boerse Group |

Orderbook Visualization and Analysis Abstract | Slides |

|

| 12:45 | LUNCH BREAK | ||

| 14:00 | Chris Parmer Plotly |

Interactive 2d & 3d Financial Plotting with plot.ly Abstract |

|

| 14:30 | Dr. Malcolm Sherrington Amis Consulting |

Julia as a HPC Alternative for Quant Finance Abstract | Slides |

|

| 15:00 | Dr. Miguel Vaz d-fine |

Market Risk Analytics and Aggregation with Python & Spark Abstract | Github Repo |

|

| 15:30 | AFTERNOON BREAK | 16:00 | Felix Zumstein, CFA Zoomer Analytics |

xlwings — Scalable Financial Analytics with Python & Excel Abstract | Slides | Github Repo |

| 16:30 | Dr. Yves Hilpisch The Python Quants |

Open Source Deployment via the Browser Abstract | Slides |

|

| 16:50 | CLOSING REMARKS & DISCUSSION | ||

| 17:00 | CONFERENCE END |

The Python Quants Group focuses on the use of Python and Open Source software for Quantitative Finance and Data Science.

The group provides browser-based, scalable solutions for financial analytics (http://quant-platform.com) and data science (http://datapark.io). It also develops and maintains the Python-based Open Source library DX Analytics (http://dx-analytics.com). In addition, the group offers consulting, development and training services.

Dr. Yves J. Hilpisch (https://hilpisch.com), the group's founder, is author of "Python for Finance" (O'Reilly) and "Derivatives Analytics with Python" (Wiley Finance). He organizes Meetup groups and conferences in Frankfurt, Berlin, London and New York. He is also lecturer for Computational Finance at the CQF program (http://cqf.com).