In [1]:

% pylab inline

Populating the interactive namespace from numpy and matplotlib

What does a quant do in commodities trading?¶

- model development

- portfolio optimisation

- trading strategies

- pricing of complex products (storage, tolling, swing contracts)

Example: Gas storage¶

- natural gas can be stored

- used to

- meet load variations

- speculation (buy low, store, sell high)

- subject to physical constraints...

- injection and withdrawal rate depend on time and current amount of gas stored

- minimum and maximum storage capacity can vary with time

- ...find an optimal strategy

In [2]:

import numpy as np

import pandas as pd

from datetime import datetime

start_date = datetime(2015, 7, 1)

end_date = datetime(2016, 7, 1)

dates = pd.date_range(start_date, end_date)

max_inventory = pd.TimeSeries(3640, index=dates)

max_inventory[10:] = 3200

min_inventory = pd.TimeSeries(0, index=dates)

min_inventory[10:] = 200

with_rate = pd.Series([2, 4, 8, 15, 23, 30, 35, 38, 40, 42, 43, 43],

index=[0, 1300, 1550, 2000, 2150, 2550, 2800, 3100, 3150, 3200, 3350, 3600])

inj_rate = pd.Series([27, 26, 25, 24, 23, 22, 21, 20, 17, 11, 10, 5],

index=[0, 1300, 1550, 2000, 2150, 2550, 2800, 3100, 3150, 3200, 3350, 3600])

wth_rate_constraints = pd.DataFrame({'min': pd.Series(2, index=dates),

'max': pd.Series(45, index=dates),

})

inj_rate_constraints = pd.DataFrame({'min': pd.Series(2, index=dates),

'max': pd.Series(26, index=dates),

})

In [3]:

storage_params = {'name': 'TestStorage',

'start_inventory': 2500,

'max_inventory': max_inventory,

'min_inventory': min_inventory,

'with_rate': with_rate,

'inj_rate': inj_rate,

'inj_cost': 0,

'with_cost': 0,

'end_inventory': 2500,

'storage_start_date': start_date,

'storage_end_date': end_date,

'wth_rate_constraints': wth_rate_constraints,

'inj_rate_constraints': inj_rate_constraints,

}

In [4]:

import btglib.quant.models.storage as sc

storage = sc.Storage(storage_params)

In [5]:

curve = 20*pd.Series(np.sin(np.linspace(0,10,len(dates))/1.5-0.5), index=dates)+40

storage.optimize(curve, curve)

storage.plot();

In [6]:

curve = 20*pd.Series(np.sin(np.linspace(0,10,len(dates))/1.5+1), index=dates)+40

storage.optimize(curve, curve)

storage.plot();

The optimal strategy depends on the gas price curve

...which we don't know...

...so we generate scenarios

In [7]:

from btglib.quant.models.simulator import Simulator

model_parameters = {'distribution': 'LogNormal',

'volatility': np.array([0.1]*len(dates))[:,None],

'correlation': np.eye(1),

'names': ['gas'],

}

simulator = Simulator('5-Jun-2015', dates, curve[:,None], model_parameters)

sims = simulator.generate_paths(100)

In [8]:

plt.plot(sims.ix[0,:,:], color='k', alpha=0.1);

plt.plot(curve, color='r', linewidth=2);

Stochastic optimisation problem¶

- optimal strategy under uncertainty

- Monte-Carlo simulation with different distributions

- large optimisation problems

- price sensitivities

Why Python?¶

- ideal for start-up

- quick cycle from idea to prototype to tool

- "batteries included" - scientific libraries, visualisation tools, documentation

- python may be slow...but cython (c/c++) is not!

To trade complex products one first needs to be able to...trade!¶

In [9]:

trades = pd.DataFrame({'Product': ['WkEnd 04/07-05/', 'Q315', 'Aug 15'],

'Market': ['Germany Baseload', 'Germany Peaks', 'Germany Baseload'],

'Volume': [50, -10, 20]})

- Building an ETRM (Energy Trading and Risk Management system)

- parse trades

- calculate positions and PnL per trader/book/strategy

- produce custom reports

In [10]:

trades

Out[10]:

| Market | Product | Volume | |

|---|---|---|---|

| 0 | Germany Baseload | WkEnd 04/07-05/ | 50 |

| 1 | Germany Peaks | Q315 | -10 |

| 2 | Germany Baseload | Aug 15 | 20 |

In [11]:

from btglib.utils import parse_traded_product

schedules = [parse_traded_product(p, m, datetime.now(), v) for p,m,v in trades[['Product','Market','Volume']].values]

position = pd.concat(schedules, axis=1).sum(axis=1)

position.plot();

ETRM¶

- trade processing with

re - positions generation/aggregation with

pandas - reporting with

reportlab - interface with Excel using

pyxll

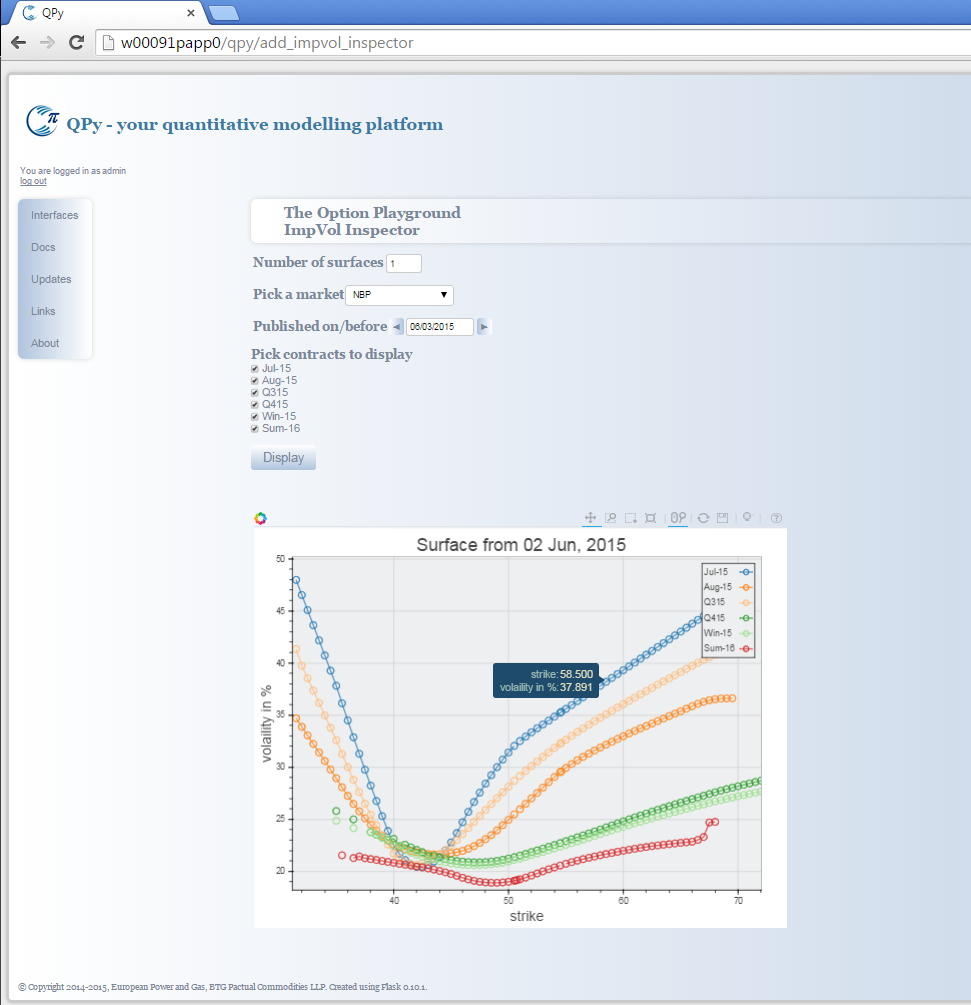

All of these require an implied volatility surface

In [12]:

from IPython.display import HTML

HTML('<iframe src=http://data.theice.com/MyAccount/Login.aspx?ReturnUrl=~\ViewData\Default.aspx width=1060 height=550></iframe>')

Out[12]:

Web-scraping with Python¶

requestsfor simple web pagesseleniumwhen we need to drive a web browser to navigate to the data- portable software testing framework for web applications

- compatible with most modern browsers

- bindings for a number of popular programming languages, including Python (and some others like Java, C#, Groovy, Perl, PHP and Ruby)

BeautifulSoupto parse the data

In [13]:

from IPython.display import HTML

HTML('<iframe src=https://plot.ly/~tbaeva/98/vol-surface-25-feb-2015/ width=960 height=700></iframe>')

Out[13]:

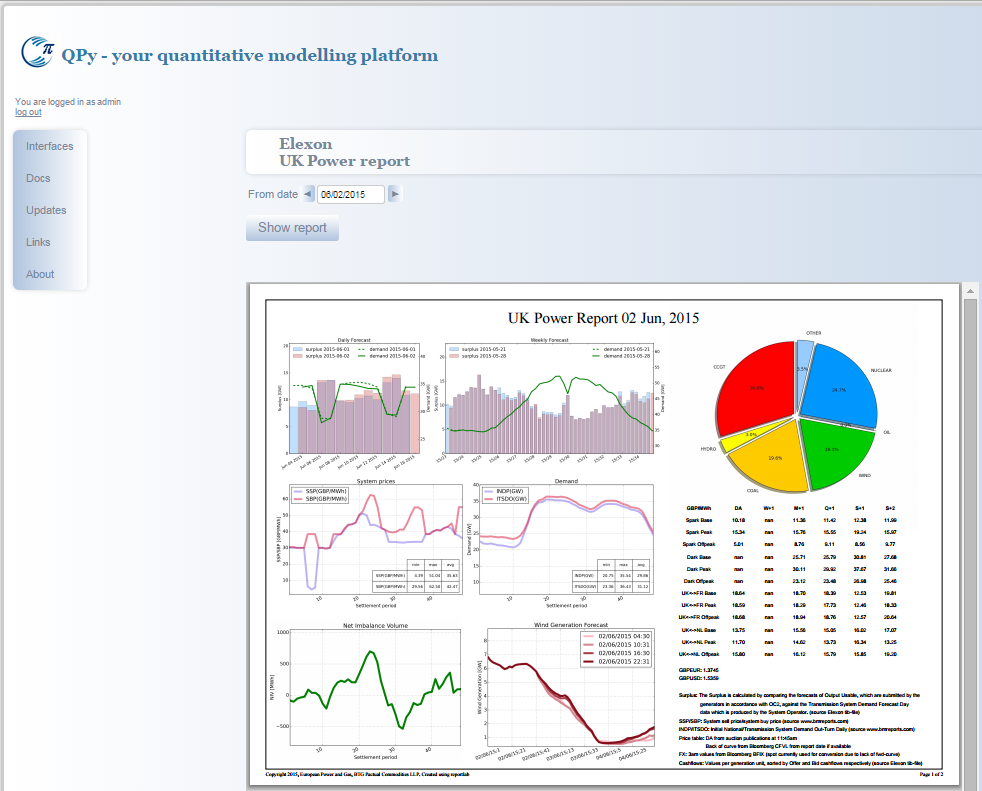

Automation, reporting, alerting¶

- python is great for automating tasks to scrape data, process and produce model results

- ...but also to produce and send out custom reports

- reports can be built with

reportlaband saved as pdf - emailing is easy with

smtplib

Automation, reporting, alerting¶

- reading your Outlook to automatically process data (e.g. from brokers)

In [14]:

import win32com.client

outlook = win32com.client.Dispatch("Outlook.Application").GetNamespace("MAPI")

inbox = outlook.GetDefaultFolder(6)

last_message = inbox.Items.GetLast()

print last_message.sender()

print last_message.subject

Yves Hilpisch RE: OSQF Conference in Frankfurt 05.06.2015

Deploying models to the desk¶

- traders love Excel

- python modules can be used from Excel, e.g. via

pyxll(Tony Roberts) - easy to centralise application modules and keep them under version control

- however...

- requires python installation on trader's machine

- package updates locally

- ...and traders don't like rebooting

Deploying models to the desk¶

- web interface

- models are triggered from the browser

- models run on a server

- results displayed on browser

- model runs can be logged

- easy to embed interactive plotting!

Web Interface¶

- built using

flaskandjinja - allows to have interface, documentation, wiki etc in one place

- running via Apache

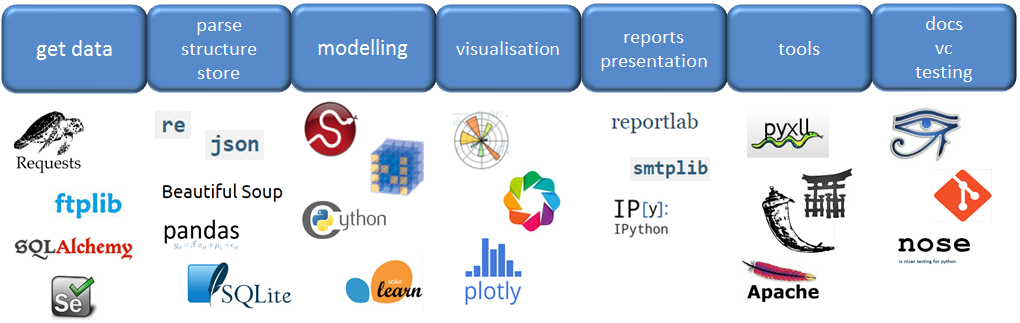

In conclusion¶

- python is traditionally seen as a scientific language (scientific libraries)

- due to python's versatility and rich ecosystem it can be used to build a trading business from scratch

- full suite from data collection, to modelling, to visualisation, to automation, reporting and alerting, to great user interfaces

thanks!¶